eToro is a social trading platform that offers a wide range of financial instruments for trading, including stocks, commodities, currencies, and cryptocurrencies. The platform is user-friendly and offers a variety of tools and features for both novice and experienced traders

Table of Contents

| Pros | Cons |

| – User-friendly interface: eToro’s platform is easy to navigate and understand, making it suitable for both novice and experienced traders. – Wide range of assets and markets: The platform offers a variety of financial instruments for trading, including stocks, commodities, currencies, and cryptocurrencies. – CopyTrader feature: This feature allows users to automatically copy the trades of other traders on the platform, which can be useful for learning and building trading strategies. – Educational resources: eToro offers a variety of educational resources, such as webinars and tutorials, to help users learn about trading. 24/7 customer support: eToro offers customer support via live chat and email, which is available 24/7. | – Fees: eToro’s fees may be a bit high compared to other online trading platforms. While the platform does not charge commission on trades, there is a spread that varies depending on the asset being traded, and withdrawals and deposits also have a small fee. – Customer service: Some users have reported that the customer service can be slow to respond and not always helpful. – Limited customization: Some experienced traders may find that the platform lacks customization options and advanced features. – Limited access to markets: eToro does not offer access to all markets and assets for trading, like some other platforms. Some countries are restricted from using their services |

CopyTrader by eToro

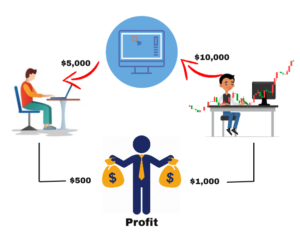

CopyTrader is a feature offered by eToro, a social trading platform. It allows users to automatically copy the trades of other traders on the platform. This means that if you choose to copy a trader, the platform will automatically execute the same trades on your account as the trader you are copying.

CopyTrader allows users to connect with other traders and learn from their strategies. It can be particularly useful for novice traders who want to learn from more experienced traders, or for experienced traders who want to diversify their portfolio by copying multiple traders.

Users can search for traders to copy based on various criteria, such as their past performance, risk level, and the assets they trade. The platform also provides detailed information about each trader, including their portfolio, trading history, and risk level, which can help users make informed decisions about who to copy.

Users can also set a stop loss level to limit their risk and can also decide how much to invest in each trade to be copied.

It’s worth noting that copying other traders’ trades doesn’t guarantee a profit, the copied trader might have different risk management strategies, different trading styles, and different goals.

CopyTrader can be a powerful tool for novice traders who want to learn from more experienced traders, but it’s important to use it with caution and to thoroughly research the traders you are considering copying before making any trades.

What are CopyTrader and Popular Investor?

CopyTrader and Popular Investor are two features offered by eToro, a social trading platform.

- CopyTrader: This feature allows users to automatically copy the trades of other traders on the platform. This means that if you choose to copy a trader, the platform will automatically execute the same trades on your account as the trader you are copying. CopyTrader allows users to connect with other traders and learn from their strategies. Users can search for traders to copy based on various criteria, such as their past performance, risk level, and the assets they trade.

- Popular Investor: This program rewards users who demonstrate exceptional trading skills and generate consistent returns. Popular Investors are chosen based on their performance, risk management, and the consistency of their returns. Being a Popular Investor has several benefits such as increased exposure, earning money from other traders copying their trades, and access to exclusive educational resources and events.

Both features are designed to help users learn from more experienced traders, but it’s important to use it with caution and to thoroughly research the traders you are considering copying before making any trades.

How eToro works

Here is a step-by-step explanation of how eToro works:

- Sign up: To start using eToro, you will need to create an account. The process is simple and straightforward and only takes a few minutes to complete.

- Verify your identity: Once you have created an account, you will need to verify your identity. This is a standard process that is required by regulatory bodies to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Fund your account: Once your account is verified, you can fund it using a variety of methods, such as credit/debit card, bank transfer, or e-wallet.

- Browse the markets: eToro offers a wide range of financial instruments for trading, including stocks, commodities, currencies, and cryptocurrencies. You can browse the markets and find the assets that you want to invest in.

- Place your order: Once you have found the assets you want to invest in, you can place your order by specifying the amount you want to invest and the type of order you want to place (e.g. market order or limit order).

- Monitor your investments: You can monitor your investments and track their performance in your eToro account. You can also set stop-loss and take-profit orders to manage your risk.

- CopyTrader: eToro’s CopyTrader feature allows users to automatically copy the trades of other traders on the platform, which can be useful for learning and building trading strategies. Users can search for traders to copy based on various criteria, such as their past performance, risk level, and the assets they trade.

- Social Trading: eToro allows users to connect with other traders and share their strategies, which can be beneficial for networking and learning from others. Users can follow other traders, see their portfolio and trading history, and replicate their trades.

It’s worth noting that the platform also offers a variety of educational resources, such as webinars and tutorials, to help users learn about trading and investing.

What is eToro Club?

eToro Club is a loyalty program offered by eToro, a social trading platform. The program rewards users for their trading activity on the platform. The program is designed to encourage users to trade more frequently and to increase their trading volume.

eToro Club has different levels, each level has different perks and benefits. The levels are:

- Bronze: This is the first level of the program and is awarded to users who have a minimum of $5,000 in their trading account and have completed at least one trade.

- Silver: This level is awarded to users who have a minimum of $10,000 in their trading account and have completed at least ten trades.

- Gold: This level is awarded to users who have a minimum of $25,000 in their trading account and have completed at least 25 trades.

- Platinum: This level is awarded to users who have a minimum of $50,000 in their trading account and have completed at least 50 trades.

- Diamond: This level is awarded to users who have a minimum of $100,000 in their trading account and have completed at least 100 trades.

As you move up the levels, you will have access to exclusive features, benefits, and perks such as exclusive educational resources, trading webinars, and personal account manager.

eToro in U.S. States

eToro is not available in all U.S. states. The platform is currently only available in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

It’s worth noting that eToro has plans to expand its services to more states in the near future. However, regulations and laws can change and it’s always good to check eToro’s website for the most up-to-date information.

Also, eToro’s services may be restricted for U.S. citizens living abroad as well as for some specific U.S. territories like Puerto Rico, Guam and U.S Virgin Islands.

Alternatives to Consider

There are several alternatives to eToro that you can consider if you’re looking for a trading platform. Some of the most popular options include:

- Robinhood: This platform offers commission-free trading for stocks, options, and cryptocurrencies, and has a user-friendly interface.

- TD Ameritrade: This platform offers a wide range of investment options, including stocks, options, ETFs, and mutual funds. It also offers trading on a variety of international markets.

- Fidelity: This platform offers a wide range of investment options, including stocks, options, ETFs, and mutual funds. It also offers trading on a variety of international markets and has a strong reputation for its customer service.

- Interactive Brokers: This platform offers a wide range of investment options, including stocks, options, ETFs, and mutual funds. It also offers trading on a variety of international markets and is geared towards more advanced traders.

- Coinbase: This platform is a leading cryptocurrency exchange and offers trading in a wide range of cryptocurrencies. It also offers a user-friendly interface and is a regulated platform.

- Binance: This platform is one of the largest and most popular cryptocurrency exchanges in the world. It offers trading in a wide range of cryptocurrencies and also has an exchange platform with a variety of trading pairs.

Invest in stocks, ETFs, and crypto

You can invest in stocks, ETFs, and crypto with eToro by following these steps:

- Sign up for an account: To start investing with eToro, you will need to create an account. The process is simple and straightforward and only takes a few minutes to complete.

- Verify your identity: Once you have created an account, you will need to verify your identity. This is a standard process that is required by regulatory bodies to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Fund your account: Once your account is verified, you can fund it using a variety of methods, such as credit/debit cards, bank transfers, or e-wallets.

- Browse the markets: eToro offers a wide range of financial instruments for trading, including stocks, ETFs, and crypto. You can browse the markets and find the assets that you want to invest in.

- Place your order: Once you have found the assets you want to invest in, you can place your order by specifying the amount you want to invest and the type of order you want to place (e.g. market order or limit order).

- Monitor your investments: You can monitor your investments and track their performance in your eToro account. You can also set stop-loss and take-profit orders to manage your risk.

It’s worth noting that these platforms may have different fees, supported assets and regulations, it’s always good to research and compare the platforms that better suit your needs and preferences.

List of Cryptocurrencies to Trade

eToro enables trading in a wide range of cryptocurrencies on their platform, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash (DASH)

- Stellar (XLM)

- Ethereum Classic (ETC)

- NEO (NEO)

- EOS (EOS)

- Cardano (ADA)

- IOTA (IOTA)

- TRON (TRX)

- Zcash (ZEC)

- Binance Coin (BNB)

- Chainlink (LINK)

- Cosmos (ATOM)

- Crypto.com Coin (CRO)

- Filecoin (FIL)

- Polkadot (DOT)

It’s worth noting that eToro may add or remove some cryptocurrencies from the list in the future, so it’s always good to check the platform for the most up-to-date information. Also, eToro supports trading crypto-assets in the form of CFDs (contracts for difference) which means you’re not owning the underlying asset, it’s the difference between the buy and the sell price that you’re trading. It carries different implications compared to buying and holding the actual crypto-assets.

Compare to Similar Brokers

Here is a comparison of eToro to similar brokers:

- Robinhood: Both eToro and Robinhood are commission-free trading platforms, but eToro offers a wider range of financial instruments for trading, including commodities and currencies. Additionally, eToro has a social trading feature (CopyTrader) that allows users to copy the trades of other traders, while Robinhood does not have a similar feature.

- TD Ameritrade: Both eToro and TD Ameritrade offer a wide range of investment options, including stocks, options, ETFs, and mutual funds. However, TD Ameritrade has a more advanced trading platform geared towards experienced traders and offers access to more international markets. Additionally, TD Ameritrade doesn’t have social trading feature like eToro’s CopyTrader.

- Fidelity: Both eToro and Fidelity offer a wide range of investment options, including stocks, options, ETFs, and mutual funds. Both platforms also offer trading on a variety of international markets. Fidelity is known for its customer service and research tools, while eToro has a more user-friendly interface and a social trading feature (CopyTrader).

- Interactive Brokers: Both eToro and Interactive Brokers offer a wide range of investment options, including stocks, options, ETFs, and mutual funds. However, Interactive Brokers is geared towards more advanced traders and offers access to more international markets and a wider range of trading options than eToro.

- Coinbase: Both eToro and Coinbase offer trading in a wide range of cryptocurrencies, but eToro also offers trading in stocks, commodities, and currencies. Coinbase is a leading cryptocurrency exchange, while eToro is a social trading platform.

It’s worth noting that these platforms may have different fees, supported assets and regulations, it’s always good to research and compare the platforms that better suit your needs and preferences.

EToro is best for

eToro is best for individuals who are looking for a user-friendly and accessible social trading platform. The platform is suitable for both novice and experienced traders and offers a wide range of financial instruments for trading including stocks, commodities, currencies, and cryptocurrencies.

The platform is best for:

- Novice traders: eToro offers a variety of educational resources, such as webinars and tutorials, to help new traders learn the basics of trading. Additionally, the CopyTrader feature allows novice traders to copy the trades of more experienced traders, which can help them learn and build their own trading strategies.

- Experienced traders: eToro offers a wide range of assets and markets for trading, and also offers a variety of trading features, such as stop-loss orders, limit orders, and take-profit orders, which can be useful for more advanced traders. Additionally, the CopyTrader feature allows experienced traders to connect with other traders and share their strategies, which can be beneficial for networking and learning from others.

- Traders who prefer low fees: eToro offers a low fees structure and doesn’t charge commission on trades, it offers a spread that varies depending on the asset being traded, and withdrawals and deposits also have a small fee.

- Traders who prefer copy trading: eToro’s CopyTrader feature allows users to automatically copy the trades of other traders on the platform, which can be useful for learning and building trading strategies.

Conclusion

eToro is a social trading platform that offers a wide range of financial instruments for trading, including stocks, commodities, currencies, and cryptocurrencies.

The platform is user-friendly and offers a variety of tools and features for both novice and experienced traders.

It has a low fees structure and allows users to connect with other traders and share their strategies through its CopyTrader feature.

The platform also provides a wide range of educational resources, such as webinars and tutorials, to help users learn about trading and investing.

However, eToro is not available in all U.S. states, and some users have reported that the customer service can be slow to respond and not always helpful.

Additionally, eToro’s fee structure and regulations may vary depending on the country you’re in. It’s always good to check the platform’s website for the most up-to-date information and compare it to other platforms before deciding to invest.

FAQs

Is eToro legit?

eToro is a legitimate online trading platform that is regulated by several financial authorities around the world. eToro is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Monetary Authority of Singapore (MAS) in Singapore. These regulatory bodies ensure that eToro adheres to strict rules and regulations regarding the protection of client funds, the segregation of client funds from company funds, and the proper handling of client complaints.

Does eToro give you money?

eToro does not give money to its users. The platform operates as an online trading and investment platform, which allows users to buy and sell a variety of financial instruments, including stocks, commodities, currencies, and cryptocurrencies. Users can make money by buying assets at a low price and selling them at a higher price, or by earning dividends from stocks they own.

What is the minimum deposit for eToro?

The minimum deposit for eToro is $200. However, it’s worth noting that the minimum deposit may vary depending on the country you are in and may change in the future. It’s always good to check the eToro website or contact customer support for the most up-to-date information.

It’s also worth noting that eToro offers a virtual trading feature that allows you to practice trading with a virtual account before you start trading with real money. This feature can be useful for getting familiar with the platform and testing out different trading strategies.

How do I get my money out of eToro?

1. Log in to your eToro account: Go to the eToro website and log in to your account using your email and password.

2. Go to the “Withdraw” page: Once you are logged in, go to the “Withdraw” page, which is usually located in the “Account” or “Funds Management” section of the platform.

3. Select the account: eToro allows you to have multiple accounts, so make sure you select the account from which you want to withdraw funds.Enter the amount you want to withdraw: Enter the amount of money you want to withdraw in the designated field. Keep in mind that eToro may have a minimum withdrawal limit.

4. Choose the withdrawal method: eToro offers different withdrawal methods, such as bank transfer, credit/debit card, and e-wallet. Choose the method you prefer and enter the necessary information, such as your bank account or credit card details.

5. Confirm the withdrawal: Review the details of your withdrawal and make sure everything is correct. Then, confirm the withdrawal by clicking the “Withdraw” button.

Wait for the withdrawal to be processed: eToro will process your withdrawal request, and the funds will be transferred to your

Why can’t I withdraw all my money from eToro?

There could be several reasons why you may not be able to withdraw all of your money from eToro:

1. Minimum withdrawal limit: eToro may have a minimum withdrawal limit, so you may not be able to withdraw an amount that is below this limit.

2. Margin requirements: eToro uses leverage to allow users to trade with more money than they have in their account. If you are using leverage, you may not be able to withdraw all of your money because a portion of it is being used as collateral for your open trades.

3. Account restrictions: eToro may impose certain restrictions on your account, such as a withdrawal limit or a freeze on your account, if you have violated their terms of service or if they suspect fraudulent activity on your account.

4. Fees: eToro may charge fees for withdrawals, and the amount of fees may vary depending on the withdrawal method and the country you are in.

5. Processing time: eToro will process your withdrawal request, but it may take some time for the funds to be transferred to your account. Withdrawals can take up to 5 business days to be processed.

It’s important to check the eToro’s website or contact customer support for the most up-to-date information about withdrawal limits, fees and processing time.