Binance US is a cryptocurrency exchange that allows users to buy, sell, and trade a range of cryptocurrencies. It was founded in 2017 and has since become one of the most popular exchanges in the world.

Table of Contents

Binance is one of the fastest growing cryptocurrency exchanges in the world. It was founded by Changpeng Zhao and is headquartered in Hong Kong.

Binance has three core functions:

- a cryptocurrency exchange,

- a place to trade crypto-to-crypto

- and an ICO launching platform.

The company takes security very seriously, which is why it stores 98% of all funds offline in cold storage.

To use Binance US, you will first need to create an account on the platform. This will require you to provide some personal information and may also require you to verify your identity. Once your account is set up, you can deposit funds into it using a bank transfer or a cryptocurrency transfer.

Once you have funds in your Binance account, you can start buying, selling, and trading cryptocurrencies. To do this, you will need to navigate to the “Exchange” section of the platform and choose the cryptocurrency pair that you want to trade. For example, if you want to trade Bitcoin for Ethereum, you would choose the BTC/ETH pair.

You can then place an order to buy or sell the cryptocurrency at a specific price, or you can choose to use the platform’s “Market” order feature, which will automatically fill your order at the best available price.

Is Binance US the same as Binance?

Binance.US is a cryptocurrency exchange that is owned and operated by Binance. Like other exchanges, it charges fees for the services it provides.

Can Binance be trusted?

Binance is one of the largest and most widely used cryptocurrency exchanges in the world, and it has generally received positive reviews from users. However, like any other exchange, it is not without its risks.

One risk to consider is the possibility of cybersecurity attacks, as exchanges are often targeted by hackers. Binance has experienced a number of high-profile attacks in the past, including a hack in May 2019 in which hackers stole more than 7,000 Bitcoin from the exchange. However, it’s worth noting that Binance has also implemented strong security measures to protect against such attacks, including the use of cold storage for its cryptocurrency holdings and multi-factor authentication for user accounts.

Another risk to consider is the possibility of regulatory action. Cryptocurrency exchanges operate in a somewhat legal gray area, and the regulatory landscape is constantly evolving. It’s possible that Binance or other exchanges could face regulatory issues in the future.

Is Binance legal in the US?

Yes, Binance US is legal in the United States. However, it should be noted that Binance is not available to users in every state. Binance.US, a separate entity owned and operated by Binance, is available to users in most states, but it is not available to users in a few states, including Alabama, Alaska, Connecticut, Florida, Georgia, Hawaii, Idaho, Louisiana, New York, North Carolina, Oregon, Vermont, and Washington.

It’s also worth noting that the regulatory landscape for cryptocurrency exchanges in the United States is constantly evolving. While it is currently legal to use exchanges like Binance in the US, it’s possible that regulatory conditions could change in the future. It’s always a good idea to keep an eye on developments in this area and be aware of any potential changes that could affect your ability to use cryptocurrency exchanges.

Binance Kodex

Binance Kodex is a platform that is operated by the Binance cryptocurrency exchange. It is a community-driven platform that allows users to share and discuss trading strategies, market analysis, and other related topics.

On Binance Kodex, users can find a range of resources, including educational articles, trading tools, and a social forum where they can connect with other traders and exchange ideas. The platform is designed to be a resource for both experienced traders and those who are new to the cryptocurrency market.

It’s worth noting that Binance Kodex is not the same as the main Binance exchange, which is a platform for buying, selling, and trading cryptocurrencies. Instead, it is a separate platform that is focused on providing educational and community resources for traders.

Binance Quant Staking

Binance Quant Staking is a staking service that is offered by the Binance cryptocurrency exchange. Staking is the process of holding a certain amount of a cryptocurrency in a wallet and participating in the validation of transactions on a blockchain in order to earn rewards.

With Binance Quant Staking, users can earn rewards by staking certain cryptocurrencies that are supported by the service. The specific cryptocurrencies that are supported and the rewards that are offered may vary over time.

To use Binance Quant Staking, users will need to have an account on the Binance exchange and hold the supported cryptocurrencies in their Binance wallet. They can then choose to participate in staking by opting in to the service through their account settings.

It’s worth noting that staking carries some risks, including the risk of losing your staked funds if the blockchain experiences a hard fork or other issue. It’s always a good idea to carefully consider the risks and rewards of any staking service before participating.

What is Binance US trading fees?

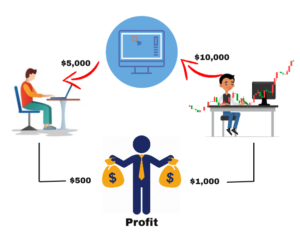

Binance US charges a flat fee of 0.1% for each trade that you make on the platform. This fee is applied to both the maker and the taker of the trade, meaning that both the person placing the order and the person filling the order will be charged the same fee.

In addition to the flat trading fee, Binance US also charges a withdrawal fee for each cryptocurrency that you withdraw from the exchange. These fees vary depending on the specific cryptocurrency, but they are typically based on the size of the transaction and the network fees associated with the withdrawal.

It’s worth noting that Binance US offers a number of promotions and discounts that can reduce or eliminate the trading fees that you pay on the platform. For example, they may offer fee-free trading periods or discounts for users who hold certain amounts of Binance’s native token, BNB.

FAQ

Binance yearly revenue?

Accordingly Reuters: On spot trading volume of $4.6 trillion in the year to October, Binance may have earned revenue of up to $4.6 billion, Reuters calculated, based on data from researcher CryptoCompare. Charging fees of up to 0.04% on its derivatives volumes of $16 trillion, Binance may have earned revenues of up to $6.4 billion

Is Binance bigger or Coinbase?

Binance is one of the largest cryptocurrency exchanges in the world, and it is known for its high trading volume and wide range of supported cryptocurrencies. Coinbase is also a large and well-known exchange, but it is not as large as Binance in terms of trading volume or the number of cryptocurrencies it supports.

Does Binance have debt?

Accordingly Bloomberg: User assets at Binance are all backed 1:1 and Binance’s capital structure is debt free.” “We maintain hot wallet balances to ensure that we always have more than enough funds to fulfill withdrawal requests and we top up hot wallet balances accordingly,” the spokesperson added.

Binance you temporarily can’t withdraw

To protect your account’s security, after performing certain security operations, such as changing your password, your account’s withdrawal function will be temporarily suspended for 24 or 48 hours. The withdrawal function will be resumed automatically after the suspension period.

Conclusion

Binance is one of the largest and most popular cryptocurrency exchanges in the world, and it has many features that make it attractive to users. However, like any other exchange, it also has some disadvantages that users should be aware of. Here are a few potential disadvantages of using Binance:

- Complexity: Binance offers a wide range of features and trading options, which can be overwhelming for new users. It may take some time to learn how to use the platform effectively.

- Security risks: As with any exchange, there is a risk of cybersecurity attacks on Binance. The exchange has experienced a number of high-profile attacks in the past, including a hack in May 2019 in which hackers stole more than 7,000 Bitcoin. While Binance has implemented strong security measures to protect against such attacks, there is always a risk that your funds could be lost due to a security breach.

- Regulatory risk: Cryptocurrency exchanges operate in a somewhat legal gray area, and the regulatory landscape is constantly evolving. It’s possible that Binance or other exchanges could face regulatory issues in the future.

- High fees: Binance charges a flat trading fee of 0.1% for each trade, which is higher than the fees charged by some other exchanges. Additionally, the exchange charges withdrawal fees for each cryptocurrency that you withdraw from the platform.

- Limited payment options: Binance only accepts a limited number of payment methods, including bank transfers and certain cryptocurrencies. This may make it difficult for some users to deposit funds into the exchange.

These are just a few of the potential disadvantages of using Binance. It’s always a good idea to carefully consider the risks and limitations of any platform before using it.