Social trading is a type of trading in financial markets that involves the use of social media and online trading platforms to connect with other traders, share information and ideas, and copy the trades of successful investors.

Table of Contents

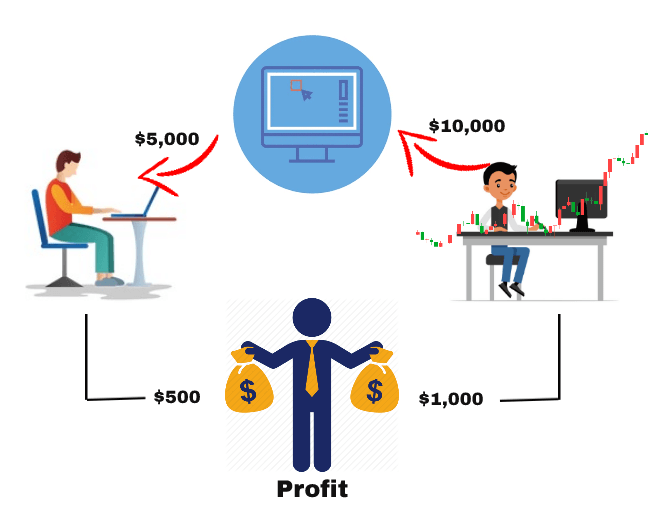

How Social Trading Works

It allows traders to follow and automatically replicate the trades of other traders in their network, potentially helping to diversify their portfolio and increase their chances of success. Social trading platforms may also offer tools and features such as analysis, alerts, and discussion forums to help traders make informed decisions and learn from their peers.

How do I start social trading

To start social trading, you will need to choose a social trading platform and open an account. There are many different social trading platforms available. Some things to consider when choosing a platform include the fees, the available traders or portfolios to follow, and the tools and resources that are offered.

Once you have opened an account, you will need to fund it with money that you can use to place trades. Many social trading platforms allow you to connect your account to a funding source, such as a bank account or credit card, to make it easy to deposit and withdraw funds.

To start copying trades, you will need to find a trader or portfolio to follow and set up your account to automatically replicate their trades. Some platforms allow you to specify how much of your account balance you want to allocate to each trade, and may also offer risk management tools to help you limit your potential losses.

It’s important to remember that social trading carries the same risks as any other form of trading and investing, and you should carefully consider your financial goals and risk tolerance before getting started. It’s also a good idea to diversify your portfolio by following multiple traders or portfolios, rather than putting all your money into a single strategy.

Most popular social trading platforms

There are many social trading platforms available, and the popularity of each platform can vary depending on the country and the specific target audience. Some of the more popular social trading platforms include:

- eToro: eToro is a multi-asset social trading platform that offers both manual and copy trading. It is available in more than 140 countries and supports a wide range of asset classes, including stocks, forex, cryptocurrencies, and commodities.

- ZuluTrade: ZuluTrade is a social trading platform that allows traders to follow and copy the trades of other traders. It offers a range of tools and features, including analysis, alerts, and risk management tools.

- Tradeo: Tradeo is a social trading platform that offers both manual and copy trading, as well as tools for analysis and collaboration. It is available in a number of languages and supports a variety of asset classes.

- Ayondo: Ayondo is a social trading platform that allows traders to follow and copy the trades of successful investors. It offers a range of educational resources and tools to help traders improve their skills and increase their chances of success.

- Collective2: Collective2 is a social trading platform that connects traders with investors who are looking to follow their trades. It offers a range of tools and features to help traders track their performance and attract followers.

These are just a few examples of the many social trading platforms that are available. It’s a good idea to do your own research and compare the features and fees of multiple platforms before choosing one that meets your needs.

How much money do I need to start day trading for a living?

The amount of money you need to start day trading for a living will depend on a variety of factors, including your financial situation, your trading strategy, and your risk tolerance. Here are a few things to consider when determining how much money you need to start day trading:

- Trading capital: Most professional day traders have a minimum of $50,000 to $100,000 in trading capital, although some may have significantly more. This capital is used to cover the costs of buying and selling positions, as well as to provide a cushion in case of unexpected losses.

- Trading style: Your trading style and strategy will also affect how much money you need to start day trading. For example, if you plan to trade high-risk, high-reward strategies, you may need more capital to withstand the potential losses.

- Living expenses: In addition to trading capital, you will also need to consider your living expenses when determining how much money you need to start day trading. You should have enough savings or other sources of income to cover your expenses while you are establishing your trading business.

It’s important to note that day trading is a high-risk activity, and there is no guarantee of success. It’s a good idea to start with a smaller account and gradually build up your capital as you gain experience and develop a successful trading strategy. You should also be prepared for the possibility of losing all of your trading capital, and only use money that you can afford to lose.

Can I teach myself trading

Yes, it is possible to teach yourself trading, although it will require a significant amount of time and effort to learn the necessary skills and knowledge. Here are a few steps you can take to teach yourself trading:

- Start with the basics: Begin by learning about the basics of trading and investing, including how financial markets work, the different types of assets that can be traded, and the tools and techniques that are used to analyze and manage risk. There are many resources available, including books, online courses, and educational websites, that can help you get started.

- Practice with a demo account: Many brokers and trading platforms offer free demo accounts that allow you to practice trading with virtual money. This can be a great way to get a feel for the markets and test out different strategies without risking any of your own capital.

- Find a mentor or join a community: Consider finding a mentor or joining a community of traders where you can learn from experienced professionals and get guidance and support. You can also join online forums and discussion groups to connect with other traders and learn from their experiences.

- Keep learning and stay up-to-date: Trading is a dynamic field, and it’s important to stay up-to-date on the latest trends and developments. Make a commitment to continue learning and expanding your knowledge throughout your trading career.

It’s worth noting that learning to trade can be a challenging and time-consuming process, and it may not be suitable for everyone. It’s important to be realistic about your goals and be prepared for the risks and challenges that you may face.

Which type trading is best for beginners

There are many different types of trading, and the best one for beginners will depend on a variety of factors, including their financial goals, risk tolerance, and available time and resources. Here are a few types of trading that may be suitable for beginners:

- Long-term investing: Long-term investing, also known as buy-and-hold investing, involves buying stocks or other assets and holding them for an extended period of time, typically several years or more. This approach can be suitable for beginners because it requires a relatively low level of knowledge and expertise, and it allows you to take a more passive approach to investing.

- Mutual funds and exchange-traded funds (ETFs): Mutual funds and ETFs are types of investment vehicles that allow you to invest in a diversified portfolio of stocks or other assets. These can be suitable for beginners because they offer professional management and diversification, and they require a relatively low minimum investment.

- Social trading: Social trading involves following and copying the trades of other traders, potentially helping you to diversify your portfolio and increase your chances of success. Some social trading platforms offer tools and resources to help beginners learn about trading and make informed decisions.

It’s important to note that all types of trading and investing carry some level of risk, and it’s important to carefully consider your financial goals and risk tolerance before getting started. It may also be a good idea to seek the guidance of a financial professional, such as a financial advisor or broker, to help you make informed decisions.

F.A.Q

What is social trading?

Social trading is a form of online trading where traders can connect and share their strategies, insights, and trades with other traders. It allows traders to gain insights and knowledge from more experienced traders, and also to share their own experiences and strategies with others.

What are the benefits of social trading for beginners?

Social trading can provide many benefits for beginners including:

– Access to insights and knowledge from more experienced traders

– Ability to learn from other traders’ experiences and strategies

– Opportunity to ask questions and get feedback from other traders

– The ability to start trading with the guidance of more experienced traders

– Access to a community of traders for support and networking.

What should I look for in a social trading platform?

When looking for a social trading platform, some key factors to consider include:

– The number of traders and the amount of activity on the platform

– The range of features and tools offered

– The level of transparency and regulation

– The level of security provided

– The fees and commissions charged.

How can I protect myself from risks while social trading?

To protect yourself from risks while social trading, it is important to:

– Always do your own research and never blindly follow trades from other traders

– Be mindful of the risk and volatility of the markets

– Be aware of the fees and commissions charged by the platform

– Keep your account and personal information secure.

What are the key success factors for social trading?

Some key success factors for social trading include:

– Having a well-defined trading strategy

– Being consistent and disciplined in your approach

– Continuously learning and adapting to market conditions

– Managing risk effectively

– Staying up to date with market news and trends

– Actively participating in the community and sharing your own insights and experiences.